Press release 1/2024

HARD COAL GUARDIAN ANGEL OF THE ENERGY SUPPLY

- No security of supply without hard coal

- The Substitute Power Plant Provision Act (EKBG) must be extended

- Higher grid fees due to the return of market power plants to the grid reserve

- No energy security without the back-up of hard coal-fired power plants

- Rock solid and stable supply of hard coal

- According to two new studies, hard coal is less harmful to the climate than LNG

The year 2023 has demanded a lot from the German economy and the energy sector.

It was not a good year!

Economic output and industrial production fell. Germany hit the headlines as the "sick man of Europe".

With the shutdown of the last nuclear power plants, Germany became for the first time since 2002 net-exporter to net-importer of electricity again.

As a result, the scarce supply of electricity combined with the highest taxes, levies and surcharges in Europe after Denmark led to further increases in energy prices. In addition, the wars in Ukraine and the Middle East as well as the terrorist attacks in the Red Sea.

"All of these developments have a direct impact on our energy markets," said Alexander Bethe, Chairman of the Association of Coal Importers. "Security of supply in the electricity sector should be our top priority."

This is why the VDKi is calling on the federal government:

- The Substitute Power Plant Provision Act (EKBG) must be extended.

- The supply on the German electricity market must be increased.

According to the VDKi, it would be grossly negligent not to rely on hard coal as the guardian angel of the energy supply in the coming winters. In view of the tight budget, it is highly unlikely that enough gas-fired power plants can be built in the coming years to compensate for the dark doldrums.

Alexander Bethe: "There is no alternative to hard coal-fired power plants as back-up for Germany's energy security. Without hard coal-fired power plants, there is no security of supply.

A major advantage of hard coal-fired power plants in market operation is their great flexibility. They only produce when they are needed. In the winter of 2022/23, they contributed to security of supply and a reduction in gas consumption. In spring and summer 2023, however, when more renewable energies were available, they hardly ran at all.

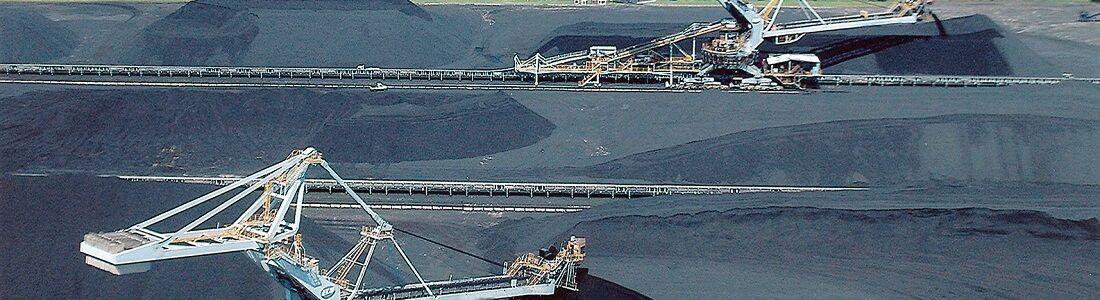

Another major advantage of hard coal is that the raw material comes from different countries and the supply routes are much more resilient than for gas. For example, the import of more than 50 % Russian coal for the German market was completely replaced in just a few months.

Even the blocking of individual shipping routes could be circumvented relatively easily; hard coal is globally available. The global market for bulk carriers is extremely efficient.

"The supply of imported coal," says Alexander Bethe, "is rock solid and stable. Its availability in the Belgian/Dutch seaports and on the German coast was and is secured at all times.

However, skilled labour and special parts are in short supply. Power plants need planning security. This also applies to logistics. Without lead time and planning horizons, the required quantities cannot be transported.

"A lack of planning security ultimately leads to a lack of supply security," says Alexander Bethe. "This is another reason why the Substitute Power Plant Provision Act (EKBG) must be extended".

Furthermore, two new reports show that the carbon footprint of LNG is significantly worse than that of imported hard coal. Hard coal-fired power plants have a better carbon footprint than LNG-fuelled power plants. This is according to a recent study by Cornell University in the US and a report by Professor Franz-Josef Wodopia from TFH Bochum.

The VDKi also welcomes the initiative of the Federal Ministry of Economics and Climate Protection BMWK to reduce greenhouse gas emissions using CCS and CCU technologies: CCS and CCU as Building blocks for a climate-neutral and competitive industry - but this technology should also be made available to the power industry as an option.

Berlin, 17 January 2024

V.i.S.d.P: Coal Importers Association e. V., Jürgen Osterhage, Managing Director